Grand Canyon University partners with venture capital firm to boost funding, resources for startups

Grand Canyon University’s Canyon Ventures is partnering with venture capital firm Flagstaff Ventures to drive growth of Arizona-based early-stage startups.

Under the partnership, Scottsdale-based Flagstaff Ventures’ portfolio companies gain access to GCU’s student workers, mentorship and support services, no-cost office and meeting space, and a network of other investors, industry leaders and entrepreneurs.

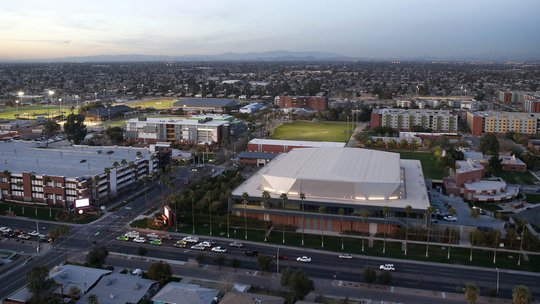

Canyon Ventures, which opened in 2020, is a business accelerator that offers companies rent-free space and is directly connected to Canyon Angels, an angel investment organization founded by entrepreneur Tim Kelley. The accelerator is home to nearly 30 startups, which employ more than 100 GCU students.

GCU’s partnership with Flagstaff Ventures fills a funding gap for early-stage, consumer companies in the state, said Robert Vera, director of Canyon Ventures.

“It’s pretty much the only consumer-focused, early-stage venture capital firm in Arizona,” Vera said of Flagstaff Ventures. “I just love that. It’s exactly what I believe we needed here in Arizona right now.”

Two undisclosed California-based early-stage companies in funding discussions with Flagstaff Ventures have already visited Arizona, toured GCU and may consider moving operations here, Vera added.

Flagstaff Ventures, founded in 2021, closed its first fund last summer with 11 portfolio companies. Flagstaff Ventures’ first fund deployed more than $6 million in capital, and its portfolio companies created an estimated 100 jobs, said Craig Weiss, founder and managing partner of Flagstaff Ventures.

Raising its second fund

The venture capital firm is currently raising money for its second fund, which is slated to launch in the summer with a $100 million target, Weiss added.

“I realized the biggest challenge for so many startups is early-stage capital,” he said. “Even though we are the fifth largest city in the U.S., when I looked around, I saw there was not a lot of institutional investors that were willing to write checks to early-stage companies.”

Weiss is a former patent attorney and previously served as CEO of NJOY, an e-cigarette startup that he led to a $1 billion valuation and raised $200 million in equity prior to parting ways with the company in 2014.

New York-based hedge fund Mudrick Capital Management took a controlling stake in NJOY in 2017. In March, Altria Group (NYSE: MO) announced it was acquiring NJOY in a $2.75 billion cash deal.

Weiss said he’d like to see the partnership between Flagstaff Ventures and Canyon Ventures flourish in the coming years.

“We’re very serious about supporting early-stage entrepreneurs in the consumer space,” Weiss said. “We are very committed to being a part of what I think is a very exciting ecosystem that is being formed here in Phoenix,” Weiss said.